01 January 2020

roadmap

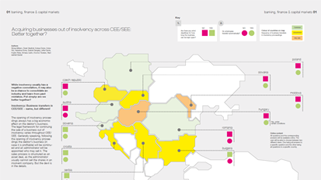

bulgaria

croatia

czech republic

hungary

moldova

poland

serbia

slovakia

slovenia

austria

Acquiring businesses out of insolvency across CEE/SEE: Better together?

While insolvency usually has a negative connotation, it may also be a chance to consolidate an industry and learn from past mistakes. Put simply: are we better together?

Insolvency: Business transfers in CEE/SEE – same, but different!

The opening of insolvency proceedings always has a big economic effect on the debtor's business. The legal framework for continuing the sale of a business out of insolvency varies throughout CEE/SEE. Generally speaking, following the opening of insolvency proceedings the debtor's business (in case it is profitable) will be continued and an administrator will be appointed who may sell it. The sales process is structured as an asset deal, as the administrator usually cannot sell the shares in an insolvent company. But the devil is in the details.

Austria

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, regardless of the type of proceedings the administrator will continue the debtor's business. Only in case the operational business is clearly loss making will the administrator close the business immediately.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no statutory maximum period. However, administrators usually try to either sell off or close the business rather quickly to minimize their potential liability.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator as legal representative of the insolvent debtor's assets will act as "seller". Any transfer of a business will also require the consent of the creditors' committee and the insolvency court. The consent of the shareholder is not required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company. The shares still belong to the shareholder(s), despite the insolvency proceedings. In order to buy the shares a buyer would have to negotiate with the shareholders.

5. If there are competing bids, how will the winning bidder be determined?

The winning bidder will be determined solely based on the price and the ability to pay the purchase price. While judges and creditors' representatives frequently also ask whether employees will be laid-off or not, ultimately the price is the only thing that matters.

6. How does the transfer work legally?

The transfer is a pure asset deal. Every asset has to be transferred separately. There is no assumption or default option to transfer assets or contracts. In order to transfer contracts, the consent by the third party is required.

7. Do employees transfer automatically?

No, employees transfer automatically only if the business is sold in "debtor-in-possession" insolvency proceedings. In all other forms of proceedings, the employees will not transfer automatically but will have to terminate their employment with the insolvent company and sign new employment contracts with the buyer. Consequently, employee related claims do not transfer to the buyer. Employee-associations usually assist the buyer with explaining the transition to the employees and help ensuring a smooth transfer.

8.What are specifics in purchase agreement?

For the administrator it is very important to have deal security and to know what the final purchase price will be. Thus, usually there are very few or even no R/Ws and a strict limitation on R/W claims. Purchase price usually has to be paid very soon after signing. There will be next to no closing conditions accepted except for merger control clearance. Any costs are to be borne by the buyer.

9. Good to know?

Make sure to have enough people preparing the transition. Transferring the entire business means transferring each contract with a utility company, suppliers, employees, insurance companies, etc to the new company. This can be extremely time consuming. On the positive side: administrators are usually very supportive and usually agree that certain contracts remain with the insolvent company for a couple of months if the buyer indemnifies the insolvent company for any costs (e.g. buyer is fulfilling customer contracts as subcontractor).

Czech Republic

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, the administrator will continue the debtor's business if this in line with his obligation to act with due managerial care. In case the business is irreversibly loss making, the administrator may rather close the business.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no statutory maximum period, the administrators shall consider, acting with due managerial care, for how long the business can be kept open on case-by-case basis.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator as statutory legal representative of the debtor will act as "seller". In case the business is pledged in favor of a creditor, such secured creditor may give instructions to the insolvency administrator regarding the disposal of the business. In such a case, no other consents are necessary. If the business is not pledged, the insolvency administrator needs to obtain a prior consent of the insolvency court and of the creditor's committee.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company. The shares still belong to the shareholder(s), despite the insolvency proceedings. In order to buy the shares a buyer would have to negotiate with the shareholders.

5. If there are competing bids, how will the winning bidder be determined?

Generally, if the business is sold by direct sale or in public auction, the winning bidder will be determined solely based on the price and the ability to pay the purchase price (sometimes also the method of payment of the purchase price matters, e.g. lump-sum paid in advance is preferable over payment via escrow).

6. How does the transfer work legally?

The business (as a going concern) may be transferred by one agreement, i.e. it is not necessary to transfer every asset separately (minor exception apply, e.g. registrable IP). Accordingly, all assets and liabilities pass to the buyer together with the business (including the obligations toward the employees). Yet, contrary to sale of company's business that is not insolvent, the seller is not guarantor of liabilities that passed on the buyer together with the business.

7. Do employees transfer automatically?

Yes, employees transfer automatically if a business is sold. However, as the business is sold within insolvency proceeding, the employees' claims originated prior to effectiveness of the transfer do not pass to the buyer (i.e. from the financial perspective, the buyer does not have to bear any past costs.). However, from the practical perspective, employees only rarely stay with the insolvent business, as they lease prior to the sale.

8.What are specifics in purchase agreement?

The purchase agreement must precisely specify items pertaining to the transferred business, typically set out in comprehensive attachments. Principally, purchase agreement then regulates mainly price determination and payment; all non-insolvent deal features, such as extensive RWs or indemnities, are not present.

9. Good to know?

Make sure to have enough people preparing the transition. Also, be prepared for all possible situations, as e.g. the buyer may face insufficient documentation with regards to the state of the business and which may require a thorough due diligence process in order to suitably allocate/mitigate/eliminate risks.

Romania

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain conditions. In a nutshell, the debtor's business should be continued by a special administrator (appointed by the shareholders) and/or by the judicial administrator (appointed by the court) in the two stages of the general insolvency proceedings: (i) observation period and (ii) judicial reorganization period. In case of bankruptcy the debtor's business is ceased immediately. During the observation period, the debtor continues its current activity (either under the management of the judicial administrator or under its own management, with judicial administrator's supervision).

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no maximum statutory period. The business shall be ceased when the syndic judge opens the bankruptcy proceedings.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The person in charge of the sale of the debtor's business depends on deal structure (asset deal/share deal) and the phase of the insolvency proceedings.

In the observation period, the measure should be proposed by the special administrator to the judicial administrator and approved by the creditors' committee. Yet, the sale of the debtor's entire business during the observation period may be challenged if it does not cover all the debtor's liabilities.

In the restructuring period, if such sale is included in the reorganization plan, the transaction documents need be signed only by the judicial administrator and the special administrator.

In the restructuring period, if such sale is not included in the reorganization plan, the prior approval of the creditors' assembly and of the syndic judge is required.

In the bankruptcy period, there is no business of the debtor. However, the assets shall be sold by the liquidator according to the sale rules approved by the creditors.

For the share deal the supplementary approval of the shareholders is required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company. The shares still belong to the shareholder(s), de-spite the insolvency proceedings. In order to buy the shares a buyer would have to negotiate with the shareholders.

According to the case law on the former insolvency law, the insolvent debtor cannot perform any change in the share capital except such a measure is included in a reorganization plan. In other words, in the insolvency proceedings a share deal could have been concluded only if: (i) the debtor was in judicial reorganization and (ii) such a measure was included in the reorganization plan. It is recommended to always include a potential share deal reorganization method in the plan.

5. If there are competing bids, how will the winning bidder be determined?

In principle, the winning bidder will be determined solely based on the price and the ability to pay the purchase price.

6. How does the transfer work legally?

Regarding asset deals, every asset has to individualized in the contract or separate contracts need to be concluded. There is no assumption or default option to transfer assets or contracts. In order to transfer contracts, the consent by the third party is required. For the share deal, the buyer will receive the business after the transaction is registered with the trade registry.

7. Do employees transfer automatically?

No, employees remain in the business if a share deal is concluded.

The employment agreements can be terminated by the judicial administrator subject to the statutory notice period. In case of a collective redundancy procedure, certain statutory periods are halved.

In case of a business transfer, the employees do not transfer automatically to the transferee, if the transferor is subject to a judicial reorganization (reorganizare judiciara) or bankruptcy procedure.

8.What are specifics in purchase agreement?

Usually, in large transactions, due to some unpredictable situations which may occur (challenges etc.), buyers are required to pay the purchase price to escrow accounts. In the reorganization period, the purchase agreements need to meet all the conditions provided by the reorganization plan.

9. Good to know?

The share deal is much easier option under the Romanian law taking into consideration that the company is usually "cleaned" at the closing of the insolvency proceedings. If the transaction price is lower than the total amount of debts, the unsecured creditors may file challenges which may block/postpone the transaction.

Slovenia

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain conditions. As a general rule, in reorganization proceedings the business of the debtor will continue, although in principle its scope will be limited to the regular course of business. In bankruptcy proceedings, on the other hand, the continuation of the debtor's business is an exemption to the general rule and is subject to certain conditions. In broad terms, the business of the debtor will continue if the administrator shows to the court that such continuation will achieve better terms for the sale of the debtor's assets as an undertaking and if the creditors' committee (if formed) does not oppose the continuation.

2. Are there any strict deadlines for how long the business can be kept open?

Yes. In bankruptcy proceedings the court will discontinue the business if (i) the administrator does not present a proposal for the sale of debtor's business and (ii) if the business has not been sold within one year following the administrator's proposal for the sale of debtor's business.

3. Who is selling the business (who is the person to contact) and who needs to consent?

In bankruptcy proceedings the power of representation is vested in the administrator, who will act as the seller of the debtor's assets. Transfer of business will always require the court's approval and in certain cases also the approval of creditors. The consent of the shareholders is not required.

In reorganization proceedings no forced sale of assets occurs. Any potential sale of debtor's shares or assets should therefore be agreed with the shareholders or the management of the company, as applicable. In compulsory settlement proceedings the debtor may only sell the assets which are not needed for its business, whereby such sale is subject to the court's approval.

4. Can the administrator sell only assets or also the shares in the insolvent company?

Only bankruptcy proceedings entail the transfer of power to sell the debtor's business to the administrator (i.e. in reorganization proceedings the management retains the powers of representation of the debtor). The administrator can sell only the assets of the insolvent debtor. The shares generally remain in the ownership of the shareholder(s). Thus, any transfer of shares requires the shareholder's content.

5. If there are competing bids, how will the winning bidder be determined?

While in reorganization proceedings the winning bidder is generally determined on the basis of negotiations (as in traditional M&A transactions), in bankruptcy proceedings the contract of sale will be concluded with the bidder who offers the highest price in the public auction or tender. If two or more bids are of the same value in case of a tender, the sale is executed with the bidder offering a shorter payment deadline.

6. How does the transfer work legally?

In reorganization proceedings general civil/corporate law rules apply to the sale of debtor's business. The sale may be structured as an asset deal (i.e. true sale requiring a separate transfer of every asset), a corporate restructuring (i.e. transfer of assets uno actu; e.g. sale by spin-off) or a share deal.

In compulsory settlements there is a statutory provided option to preserve the debtor's healthy core business through a transfer of spin-off to a NewCo(s), leaving behind any (unsecured) liabilities with the debtor's old corporate entity.

7. Do employees transfer automatically?

Yes. Insofar workers are part of the transferred business unit, they are automatically transferred to the buyer. The buyer becomes a universal successor of the transferred business unit, and therefore also jointly and severally liable for the employee related claims incurred up to the transfer date.

8.What are specifics in purchase agreement?

In reorganization proceedings general principles of M&A transactions apply, with certain notable procedural exemptions (e.g. exemptions to the mandatory takeover bid). In comparison to the standard M&A transactions the purchase agreements in insolvency situations typically contain a limited set of R/Ws. The scope of CPs typical for M&A transactions may be limited due to time constraints common for distressed acquisitions. On the other hand, certain insolvency proceedings milestones (e.g. confirmation of the compulsory settlement) may be included as CPs to closing.

In bankruptcy proceedings the seller's liability for material/legal defects is excluded by statutory provisions. Therefore, purchase agreements typically contain no special R/Ws and/or CPs. The purchase price must be paid within 3 months after the signing of the purchase agreement. Costs are typically born by the buyer.

9. Good to know?

Acquiring business from insolvency is in principle more complicated than traditional M&A transactions. Potential buyers should ensure to engage a team with an in-depth understanding of insolvency regulations and distress acquisition principles. In broad terms general M&A principles will to a large extent apply in the event the target is still capable of surviving by way of restructuring. In reorganization proceedings the sale will typically be structured as a share deal, asset deal or corporate restructuring (e.g. spin-off, split-off, etc.). On the other hand, in bankruptcy proceedings the sale of a "business unit" as an undertaking is the most typical form of acquiring business. In such sui generis asset deal the buyer assumes the legal position of the debtor regarding the transferred assets and become its legal successor. Sellers' liability for defects of the sold assets is excluded by the statutory provisions, therefore a thorough due diligence review is recommendable to minimize the acquisition risks.

Poland

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, the administrator will normally want to continue the debtor's business, provided that there is business rationale to do so. Formally, the administrator is required to obtain a consent of the creditor's committee to be able to continue the debtor's business for period longer than three months following the opening of the insolvency proceedings.

As an alternative to continuing the business by the administrator itself, the administrator my lease the debtor's business to an interested Party. The lessee is granted with a preemptive right of the business that may be exercised once the administrator proceeds with the sale of the business.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no statutory maximum period.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator is the seller of the business and a party to a purchase agreement (acting in its own name). The sale needs to be approved by the court or the creditor's committee (depending on the procedure used for the sale).

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company. The shares still belong to the shareholder(s), despite the insolvency proceedings. In order to buy the shares a buyer would have to negotiate with the shareholder(s).

5. If there are competing bids, how will the winning bidder be determined?

The winning bidder will be determined solely based on the price and the ability to pay the purchase price.

6. How does the transfer work legally?

The transfer is a pure asset deal. In case of sale of an entire business or its organized part, the transaction covers all assets (there is no need to transfer assets individually), subject to expressly agreed exclusions (cash and receivables are customarily excluded). Generally, contracts (except for employment contracts) are not transferred by virtue of the sale and the consent of the third party (other party to the contract) is required.

7. Do employees transfer automatically?

Yes, the employees transfer automatically and the buyer becomes party to the employment contracts. Under the currently binding law, the buyer is not liable for any employee-related claims which arose prior to the sale of business. However, a bill amending the insolvency law is expected to come into force shortly and one of the enacted changes suggests that this rule may change, i.e. that the buyer may become liable for employee-related claims which arose prior to the sale of business.

8. What are specifics in purchase agreement?

For the administrator and the court, it is very important to have deal security and to know what the final purchase price will be. Thus, usually the agreement contains no R/Ws and provides for an exclusion of statutory warranty claims and is much more simplified than non-insolvency related business purchase agreements. To large extent this results from the fact that the buyer acquires clean legal title (previous encumbrances on the assets expire) and the buyer is not liable for any debts of the insolvent debtor. Purchase price has to be paid before signing. There will be next to no closing conditions accepted except for merger control clearance (if required). Any costs are to be borne by the buyer.

9. Good to know?

Make sure to have sufficient people working on the transactions. Transferring the entire business means transferring each contact with a utility company, suppliers, employees, insurance companies, etc to the new company. This can be extremely time consuming. On the positive side: Administrators are usually supportive and cooperative in relation to the implementation of the sale and transition.

Croatia

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain conditions. The administrator will continue the debtor's business at least until the reporting hearing. Until then, the transactions which are necessary to prevent damage to the debtor will be ended. In the report hearing the creditors will decide whether or not to continue the business. This decision may be altered at any further creditor's meeting. There are no proceedings which will trigger the business to immediately close.

2. Are there any strict deadlines for how long the business can be kept open?

Yes, the business may only be continued for a maximum period of 1.5 years after the report hearing unless a bankruptcy plan is submitted to the court.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator will act as the "seller". The consent of the creditor's meeting will be required to sell a business unit (imovina kao cijelina) as well as the court needs to confirm the sale process (including the sale and purchase agreement).

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can only sell the assets of the insolvent company. The shares of an insolvent company do not form part of the insolvency estate, as they are owned by shareholder(s) (unless owned by the insolent company itself) and cannot be sold.

5. If there are competing bids, how will the winning bidder be determined?

When organizing the sales of the debtor's assets, the administrator is bound by the decisions of the creditors under which terms and conditions the particular asset shall be sold. In case of competing bids, the winning bidder shall be typically the one offering the highest purchase price.

6. How does the transfer work legally?

The transfer will be an asset deal. All assets included in the transfer need to be specified and either listed in one agreement or transferred by several agreements. Specific requirements regarding the different types of assets must be followed.

7. Do employees transfer automatically?

Yes, employees transfer automatically in case of sale of business unit. The seller is required to inform the works council, if any, and affected employees of the transfer. The employees will typically retain all rights they previously had. However, in case of transfers from an insolvent company, these rights may be decreased in accordance with the law, collective bargaining agreements or agreements between the works council and employer.

8. What are specifics in purchase agreement?

It is important that the purchase agreement does not contradict the instructions received by the creditors. Also, the sale agreement shall list all the assets which are to be transferred (e.g. in case of carving out the encumbered assets). The purchase price is to be paid as set out in the sale agreement; however, not later than 6 months as of signing (in which case adequate security for paying the purchase price must be provided). Usually there are very few (often non-negotiable) or even no R/Ws and a strict limitation on R/W claims.

9. Good to know?

The transfer will include several types of assets. It is important to comply with formal prerequisites for the transfer of each asset. If agreements shall be transferred the other party has to consent to such a transfer. Transactions on transferring the entire business (each contract with a utility company, suppliers, employees, insurance companies, etc.) to a new company can be extremely time-consuming process.

Moldova

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, subject to certain conditions. The debtor can continue its current activity which is limited to the following activities (i) the continuation of the ordinary course of business, (ii) payment of current expenses and receiving payments in connection with the ordinary course business, and (iii) financing of current expenses.

All other activities must be compulsory authorized by the insolvency court. The insolvency administrator is entitled to request the insolvency court to approve the close down of the business of the debtor.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no strict deadline. However, the practice attests lack of interest of the insolvency administrator / creditors' meeting / clients of an insolvent debtor to allowing the continuation of the business of the debtor, which is considered risky and insecure.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The responsible person is the insolvency administrator. Any transfer of a business will also require the prior consent of the creditors' committee and of the insolvency court. The consent of the shareholders is not required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

Only assets can be disposed. The shares will formally continue belonging to the shareholders, despite the insolvency proceedings.

5. If there are competing bids, how will the winning bidder be determined?

In the process of liquidation, the insolvency administrator has the duty to sell the assets for the highest price possible. Accordingly, the winning bidder will be determined on basis of the offered price and other conditions proposed (e.g. shorter term of payment, assumption of costs in relation to sale of assets, etc.).

6. How does the transfer work legally?

The transfer inside the insolvency procedure works pursuant to the same rules as an ordinary sale of the same categories of assets. The administrator is precluded to act as purchaser during such transactions.

7. Do employees transfer automatically?

Yes. In the case of sale of the enterprise as a sole complex, all valid employment contracts at the time of sale remain valid, while the purchase becomes the successor of all the rights and obligations of the Insolvent debtor. The change of a company's owner entitles the new owner to terminate the employment agreements only of the managing directors, their deputies and of the chief accountant of the sole company.

8. What are specifics in purchase agreement?

Usually, the purchase agreements are subject to a prior bid. In case only one bid is submitted, or in case there is a risk of breach of certain rights protected by law, the conclusion of the purchase agreement may be subject to direct negotiations between the purchaser and the insolvent debtor.

9. Good to know?

The party (creditor) assigning the insolvency administrator, as a rule, controls the insolvency process. Make sure that your receivables are inserted by the insolvency administrator into the preliminary / final table of receivables, if there was a miscalculation / there is a likelihood that insolvency administrator acted in bad faith or in conflict of interest. The insolvency administrator can be dismissed (removed) only by the creditors' meeting. The insolvency procedure is usually a long-lasting process, which leads inevitably to a significant depreciation of assets of the debtor. The sale of the enterprise as a sole complex can occur only after the separation of the sold assets from the interested persons (if any). If sold before the separation, the purchaser becomes the legal successor of the obligations of the debtor.

Moldova

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, subject to certain conditions. The debtor can continue its current activity which is limited to the following activities (i) the continuation of the ordinary course of business, (ii) payment of current expenses and receiving payments in connection with the ordinary course business, and (iii) financing of current expenses.

All other activities must be compulsory authorized by the insolvency court. The insolvency administrator is entitled to request the insolvency court to approve the close down of the business of the debtor.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no strict deadline. However, the practice attests lack of interest of the insolvency administrator / creditors' meeting / clients of an insolvent debtor to allowing the continuation of the business of the debtor, which is considered risky and insecure.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The responsible person is the insolvency administrator. Any transfer of a business will also require the prior consent of the creditors' committee and of the insolvency court. The consent of the shareholders is not required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

Only assets can be disposed. The shares will formally continue belonging to the shareholders, despite the insolvency proceedings.

5. If there are competing bids, how will the winning bidder be determined?

In the process of liquidation, the insolvency administrator has the duty to sell the assets for the highest price possible. Accordingly, the winning bidder will be determined on basis of the offered price and other conditions proposed (e.g. shorter term of payment, assumption of costs in relation to sale of assets, etc.).

6. How does the transfer work legally?

The transfer inside the insolvency procedure works pursuant to the same rules as an ordinary sale of the same categories of assets. The administrator is precluded to act as purchaser during such transactions.

7. Do employees transfer automatically?

Yes. In the case of sale of the enterprise as a sole complex, all valid employment contracts at the time of sale remain valid, while the purchase becomes the successor of all the rights and obligations of the Insolvent debtor. The change of a company's owner entitles the new owner to terminate the employment agreements only of the managing directors, their deputies and of the chief accountant of the sole company.

8. What are specifics in purchase agreement?

Usually, the purchase agreements are subject to a prior bid. In case only one bid is submitted, or in case there is a risk of breach of certain rights protected by law, the conclusion of the purchase agreement may be subject to direct negotiations between the purchaser and the insolvent debtor.

9. Good to know?

The party (creditor) assigning the insolvency administrator, as a rule, controls the insolvency process. Make sure that your receivables are inserted by the insolvency administrator into the preliminary / final table of receivables, if there was a miscalculation / there is a likelihood that insolvency administrator acted in bad faith or in conflict of interest. The insolvency administrator can be dismissed (removed) only by the creditors' meeting. The insolvency procedure is usually a long-lasting process, which leads inevitably to a significant depreciation of assets of the debtor. The sale of the enterprise as a sole complex can occur only after the separation of the sold assets from the interested persons (if any). If sold before the separation, the purchaser becomes the legal successor of the obligations of the debtor.

Slovakia

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, subject to certain conditions. It depends on the bankruptcy trustee – if the statutory conditions are fulfilled, which are, generally, that it is not a operationally loss making business, the value of the business or estate does not decrease as a result or that the continuance is better for the creditors that closing down the business immediately. However, trustees are often reluctant to continue businesses in bankruptcy.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no statutory maximum period. However, administrators usually try to either sell off or close the business rather quickly to minimize their potential liability.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator as legal representative of the insolvent company will act as "seller". Any transfer of a business will also require the consent of the creditors' committee and / or the secured creditors and in some cases, also the insolvency court. The consent of the shareholder is not required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company. The shares still belong to the shareholder(s) but the transfer of shares is prohibited by law. The Slovak bankruptcy proceedings are proceedings aimed at liquidation of the assets and the company.

5. If there are competing bids, how will the winning bidder be determined?

The purpose of the bankruptcy is to achieve highest proceeds for the creditors, therefore, the price is ultimately the decisive criterion.

6. How does the transfer work legally?

The rules applicable to transfer of businesses as going concern outside of insolvency apply mutatis mutandis. Therefore, all assets, rights and contracts (unless terminated by the trustee) are automatically transferred to the purchaser. As regards liabilities – unlike a transfer out of insolvency – the purchaser only assumes those that have arisen from operating the business after bankruptcy has been declared and non-monetary liabilities from employment relationships.

7. Do employees transfer automatically?

Yes.

8. What are specifics in purchase agreement?

There are no specifics required by law. However, for the administrator it is very important to have deal security and to know what the final purchase price will be. Thus, usually there are very few or even no R/Ws and a strict limitation on R/W claims. Purchase price usually has to be paid very soon after signing. There will be next to no closing conditions accepted except for merger control clearance. Any costs are to be borne by the buyer.

9. Good to know?

N/A

Serbia

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain conditions. The administrator may not take any actions that are deemed to be "actions of great importance" (such as obtaining the loan, purchasing high value equipment, lease and similar) without informing the insolvency judge and obtaining consent of the creditors committee. Further, if the debtor's assets are insignificant or not sufficient to cover the expenses of insolvency proceeding, the court will even request that the administrator sells the company's assets and cover the proceeding's expenses (unless insolvency debtor or creditors cover these expenses in advance). Finally, the creditors with at least 50% of the total receivables may decide on the first meeting of the board of creditors that proceeding continues as a bankruptcy (i.e. sale/liquidation of the insolvent debtor or its assets).

2. Are there any strict deadlines for how long the business can be kept open?

Yes. The business may be kept open by insolvency administrator until the reorganization plan is adopted which needs to be submitted to the insolvency judge within 90 days from the opening of insolvency proceeding. If a reorganization plan is not adopted, the court and administrator would initiate bankruptcy proceedings.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator as a statutory representative of the insolvent company will act as a "seller". The administrator needs to notify the court and creditors on the planned sale at least 15 days in advance. Creditors can file complaints to such notice, which will be then reviewed by the court.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell both assets and the shares in the insolvent company itself.

5. If there are competing bids, how will the winning bidder be determined?

The winning bidder will be determined solely based on the price and the ability to pay the purchase price.

6. How does the transfer work legally?

The transfer can be effected by one of the following methods: (i) sale of all or part of company's assets (i.e. pure asset deal); or (ii) sale of the shares in the company, together with all or part of its assets (i.e. mix of asset and/or share deal). In both cases, a buyer is acquiring the insolvency debtor (or only its assets) without any prior liabilities.

7. Do employees transfer automatically?

No. Employees of the insolvent company remain the employees of this company, subject to agreement between the insolvency administrator and the buyer (in case of an share deal structure). However, the buyer does not acquire any existing liabilities, i.e. the employees keep their claims against the insolvency estate.

8. What are specifics in purchase agreement?

In case of public bids, purchase price needs to be paid within 15 days from the conclusion of the agreement, unless otherwise agreed between administrator and the buyer (and subject to creditors committee's consent). In case of direct (non-public) sale between the administrator and buyer, the parties are free to agree on price and deadline for payment. Ownership rights are transferred to the buyer only after payment of the purchase price. In case of sale of the shares in the insolvency debtor, the administrator needs to conduct valuation of the company's assets. The purchase agreement needs to contain a provision that assets which were not part of the administrator's valuation become part of the insolvency estate, i.e. are not sold.

There will be next to no closing conditions accepted except for merger control clearance (if needed).

9. Good to know?

The latest amendments of the Insolvency Act should tackle one of the most pressing issues of insolvencies in Serbia, which is the proceeding's duration. According to the latest statistics, insolvency proceedings in Serbia on average last two years.

Hungary

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain conditions. In case of bankruptcy proceedings, the debtor continues the business and the administrator merely monitors it. Whereas, in case of liquidation proceedings, the administrator can either freely decide upon closing the business of the debtor or continue it with the consent of the creditor's committee.

2. Are there any strict deadlines for how long the business can be kept open?

No, there is no statutory maximum period.

3. Who is selling the business (who is the person to contact) and who needs to consent?

The administrator as legal representative of the insolvent company will act as "seller" but the creditors' consent for selling the assets are not required.

4. Can the administrator sell only assets or also the shares in the insolvent company?

The administrator can sell only the assets of the insolvent company by way of the public sale. The shares still belong to the shareholder, despite the insolvency proceedings.

5. If there are competing bids, how will the winning bidder be determined?

The administrator holds open negotiations between the bidders if the offers are practically the same price (ranging within 10% in respect of the purchase price). The winning bidder will be determined solely based on the price.

6. How does the transfer work legally?

The transfer is a pure asset deal. Every asset has to be transferred separately. There is no assumption or default option to transfer assets or contracts. In order to transfer contracts, the consent by the third party is required. However, there might be a few exceptions such as lease agreements, in which case the tenant's consent would not be requires and would stay in the lease.

7. Do employees transfer automatically?

Yes, under certain condition. In case of liquidation proceedings, employees do not transfer automatically if the assets (or a pool thereof) or the entire business is sold. Whereas, in case of bankruptcy proceedings they do automatically and so do the employee related claims.

8. What are specifics in purchase agreement?

For the administrator it is very important to have deal security and to know what the final purchase price will be. Thus, usually there are very few or even no R/Ws and a strict limitation on R/W claims. Purchase price usually has to be paid very soon after signing. There will be next to no closing conditions accepted except for merger control clearance. Any costs are to be borne by the buyer.

9. Good to know?

Bankruptcy proceedings are rarely used compared to liquidation proceedings. With regard to liquidation proceedings, most of the businesses have no assets by the time the proceeding commences.

Bulgaria

1. Will the administrator continue the business of an insolvent debtor after the opening of proceedings?

Yes, under certain condition.

2. Are there any strict deadlines for how long the business can be kept open?

Yes.

3. Who is selling the business (who is the person to contact) and who needs to consent?

Some kind of administrator.

4. Can the administrator sell only assets or also the shares in the insolvent company?

Only assets.

5. If there are competing bids, how will the winning bidder be determined?

Highest price.

6. How does the transfer work legally?

n/a

7. Do employees transfer automatically?

No.

8. What are specifics in purchase agreement?

n/a

9. Good to know?

n/a

co-authors