17 January 2018

roadmap

austria

bulgaria

croatia

czech republic

hungary

poland

romania

serbia

slovakia

slovenia

bosnia & herzegovina

türkiye

montenegro

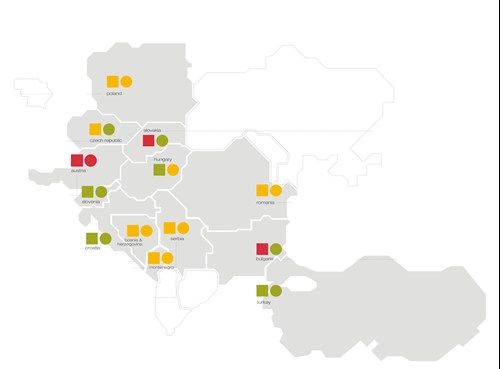

Banking secrecy in CEE - one region, different rules

Despite ongoing harmonisation and the regulatory pressure on banks to reduce NPL quotas, banking secrecy rules in various jurisdictions still create hurdles to effectively implement loan sale transactions and hamper follow-on servicing. In the pages that follow, we provide a broad, simplified overview of how the rules per jurisdiction affect the legal environment in respect of these transactions and follow-on servicing.

Austria

"Whereas market participants have found practical solutions to address banking secrecy issues at the transaction level, there also needs to be a focus on remaining compliant during the servicing period of a portfolio."

As no specific exemptions from bank secrecy exist for loan sale transactions, careful legal and process structuring is required to implement a loan sale. Ultimately, there is legal uncertainty on whether transactions in breach of banking secrecy could be challenged / void. We believe that market participants have found practical solutions to address banking secrecy issues at transaction stages, in particular via a staged disclosure of protected information and by application of the so-called "red room advisor" concept. However, there also needs to be a focus on remaining compliant during the servicing stages. In addition to proper knowledge transfer with respect to protected data, this also includes thorough compliance training of case handlers.

Bosnia & Herzegovina

"Banks may disclose information protected by banking secrecy, provided that it is disclosed in the context of a portfolio transaction to the extent this would be within the "bank's interest" to achieve a sale."

The new banking legislation adopted in 2017 introduces detailed regulation on banking secrecy for the Federation of Bosnia and Herzegovina and Republika Srpska. The new law includes a clear definition of the scope of protected information and regulatory obligations to not disclose such information, and provides for statutory exceptions. For instance, a bank is entitled to disclose protected information to the extent such a disclosure would be within the "bank's interest" during a loan sale. It is yet to be seen how the new law will be interpreted in practice.

Bulgaria

"Due to the lack of specific exemptions from banking secrecy for loan sale transactions, market participants are inclined not to disclose protected information prior to transaction signing."

As no specific exemptions from bank secrecy exist for loan sale transactions, careful legal and process structuring is required to implement a sale. For example, market participants may avoid breaches of banking secrecy by engaging legal / financial advisors to review protected information during negotiations, whereby a (potential) buyer would only receive data in an anonymised and aggregated form. From the commercial side, we believe that overall market expectations for an increase in loan sales in Bulgaria did not materialise in 2017 mainly due to new accounting requirements for Bulgaria's banking sector, which are currently being implemented by the Bulgarian National Bank with effect as of 2018 (and in parallel to IFRS 9).

Croatia

"The Croatian Credit Institution Act clearly provides for specific exemptions from banking secrecy with respect to loan sale transactions."

Pursuant to the law, banking secrecy shall not apply, inter alia, in cases when (i) the client explicitly agrees in writing that confidential information may be disclosed, (ii) that would enable a credit institution to realise its interest when selling client's receivables, or (iii) confidential information is exchanged within a group of credit institutions for risk management. Whereas, the selling of NPL portfolios has been tested to be within a bank's justifiable interest, proper analysis as to whether this exemption also applies to performing portfolios is strongly advisable.

Czech Republic

"Case law exists that supports the disclosure of protected information with respect to defaulting debtors."

The Czech Supreme Court supports the view that bank secrecy requirements do not prevent a bank from assigning its receivables of defaulting debtors, provided that the assignment of such loans has not been contractually excluded. Commercially, we expect less NPL activity due to dropping NPL ratios and overall improved NPL structures.

Hungary

"The abolition of the eviction moratorium kick started NPL transactions and such measures were followed with further, mainly positive legislation."

The main hurdle remained unchanged though: the purchase of receivables is a licensed activity in Hungary. Apart from that, the Hungarian National Bank introduced certain guidelines aiming to protect the consumers' rights when loan agreements are terminated. Nonetheless, the regulatory environment has generally improved in favour of banks, investors and servicers. One prominent example is the Hungarian National Bank's guideline addressing the issue of banking secrecy and concluding that banking secrets may be disclosed even for prospective buyers in a tender process (if such a buyer undertakes confidentiality).

Montenegro

"Still absent regulators' recognition of arguably well founded liberal interpretation of strict banking secrecy rules, leaves loan trading susceptible to a certain degree to breach of banking secrecy risk."

Strict banking secrecy rules have been relaxed by established practice formed on a liberal interpretation based on the argument that debtors' interests cannot be harmed during a due diligence exercise if their identity remains undisclosed and that full disclosure can be made to a selected purchaser, as otherwise regulation explicitly regulating loan sales would be redundant. While practice based on this liberal interpretation inspires comfort, the susceptibility of loan trading to breach of banking secrecy risk is not ruled out by the regulator or courts.

Poland

"Banking secrecy exemptions exist if portfolios are sold to securitisation funds or SPVs. A bank may also enter into sub-participation agreements with such entities."

Banking secrecy is exempted to the extent necessary to conclude and perform transfers of receivables to a securitisation fund. Such funds usually entrust servicing of acquired loans to a special servicing company (servicer), which requires authorisation of the Polish Financial Supervisory Authority. The secrecy exemption also applies to an agreement with a servicer. Both a fund and a servicer may collect and process personal data of a debtor only for purposes related to management of receivables. The banking secrecy exemption also extends to the sale of "lost receivables" and public sale of loans.

Romania

"We expect that legal uncertainty regarding client data disclosure and increased regulatory constraints will increase the load of preparatory stages and will prompt a more cautious approach to portfolio transactions."

Portfolio transactions are not exempted from general bank secrecy and data protection regimes in Romania. Moreover, legitimate interest was not tested in court as grounds for disclosure of client data. New challenges are expected as well as a result of the increase of data protection requirements and update of the sanctioning regime, starting with the entry into force of the General Data Protection Regulation in May 2018. Nonetheless, we are confident that with sufficient and careful preparation these matters can be dealt with successfully.

Serbia

"Existing legal uncertainties have recently been addressed by guidance issued by the National Bank of Serbia that is friendly to loan trading. However, information protected by banking secrecy may also qualify as a business secret and could give rise to private enforcement of damages claims."

The National Bank of Serbia confirmed in its non-binding guidance to Serbian banks that a person to whom a bank assigns claims against its debtors is exempted from the banking secrecy regime, thereby addressing legal uncertainty about whether exemptions to banking secrecy as prescribed by the Banking Act may apply to secondary debt trading. However, a banking secret may still qualify as a business secret and aggravated assigned debtors might try to bring civil law damages claims against any person who has (allegedly) violated business secrets.

Slovakia

"Slovak banking secrecy rules restrict the disclosure of information at due diligence stages unless the debtor is in default or prior consent is obtained."

Applicable banking secrecy rules do not provide any exemption for a disclosure at due diligence stages to (potential) buyers. Careful deal structuring or obtaining consent of debtors is therefore required. As for the actual assignment itself (and follow-on servicing), the law provides for an exemption that a bank may assign its receivable against and provide the assignee with the necessary documentation without the debtors consent if the debtor, despite a written warning, is in default for more than 90 calendar days.

Slovenia

"A pragmatic interpretation of the "proportionality test" imposed by Slovenian law provides for the required flexibility with respect to the disclosure of information."

Slovenia has seen a lot of activity as regards portfolio deals in the past years and the players – in particular the local banking and legal community – have been quick to identify and adapt to the key legal challenges. Notably, the legal community was quick to embrace a pragmatic interpretation of the proportionality test imposed by the law in relation to permitted disclosure of information subject to banking secrecy. In a similar vein, transferability issues (in particular concerning certain types of security interests) were quickly overcome by means of alternative legal structures with commercially equivalent results, such as synthetic structures and corporate transactions.

Turkey

"Exemptions to banking secrecy exist to allow for disclosure of protected information to specific regulated entities (set up to acquire loan portfolios), provided that a confidentiality agreement has been signed."

Turkish law provides sufficient exemptions from banking secrecy to allow for disclosure of protected information to specific regulated entities (ie asset management companies specifically licensed to take over NPLs), provided that a confidentiality agreement is entered into. Turkish non-state-owned banks have been quite active in terms of transferring their NPL portfolios to such entities. In 2017, Turkish state-owned banks have also been given the green light (from a banking secrecy perspective) to transfer their NPL portfolios.

----------

Read interview with Karel Smerak: Secrecy and portfolio transactions

authors: Laurenz Schwitzer, Milena Gabrovska, Ozren Kobsa, Gergely Szalóki, Vid Kobe, Levent Çelepçi, Tsvetan Krumov, Natálie Rosová, Paweł Halwa, Paula Weronika Kapica, Jovan Barović, Petar Kojdić

Co-Author: Costin Sandu

Laurenz

Schwitzer

Partner

austria vienna