01 February 2024

roadmap

austria

Corporate sustainability in Austria: navigating new reporting obligations

The Corporate Sustainability Reporting Directive (CSRD) marks a new chapter in transparency requirements for European companies. From next year, the number of companies required to report on their sustainability performance will gradually expand. This reporting obligation extends beyond sustainability matters, however, as it covers a wide variety of ESG topics.

The Non-Financial Reporting Directive (NFRD), implemented in Austria by the Sustainability and Diversity Improvement Act in 2017, requires companies to report on non-financial aspects like environment, social issues, human rights, anti-corruption and diversity. The CSRD, which came into force at the beginning of 2023 and is slated for implementation by 6 July 2024, significantly extends the existing reporting obligations and widens the circle of companies obliged to report.

Who needs to report?

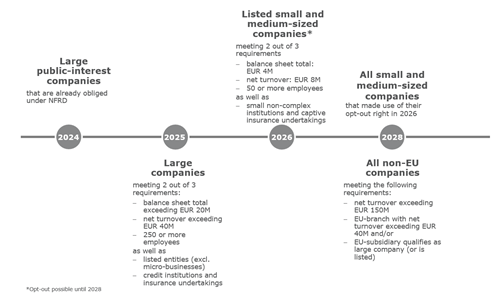

From 2025, all companies that are already obliged to report under the NFRD will be required to apply the new and stricter CSRD standards for reporting their business activities in 2024. As of 2026, the reporting obligations under the CSRD will expand to a wider group of companies fulfilling the following requirements:

What needs to be reported?

Companies are required to report on many ESG-related subjects and issues, including:

- business model and strategy (including the implementation of time-bound targets);

- organisation and governance (including board and executive composition as well as their skills and expertise, the company's business ethics, etc.);

- environmental factors (including climate change mitigation/adaption, greenhouse gas emissions, water resources, pollution, etc.);

- human rights factors (including equal treatment, working conditions);

- social impact (including employee wellbeing, labour practices, community engagement); and

- supply chain reporting (if applicable).

The CSRD does not specify the consequences for failing to adhere to its reporting requirements. Instead, enforcement and compliance are left to the individual Member States, mirroring the approach already established with the NFRD.

Reporting standards

In July 2023, the European Commission approved the first set of European Sustainability Reporting Standards (ESRS), which all companies falling under the purview of the CSRD must apply. The CSRD's overarching goal is to enhance the comprehensiveness, quality and transparency of reporting by companies subject to the CSRD. The ESRS are divided into three categories: cross-cutting standards, topical standards and sector-specific standards. Cross-cutting standards are industry/sector-independent and applicable to all companies. Sector-specific standards focus on specific sectors, like motor vehicles, road transport, oil and gas. etc. Topical standards focus on various sustainability topics, each standard on one ESG topic.

The CSRD also introduces an external audit requirement for sustainability reporting and requires publication of the reports in a digital and machine-readable format. Non-compliance can lead to penalties and loss of investment. It also requires companies bound by it to apply a "double materiality" disclosure principle, meaning they are obliged to report on how sustainability issues affect their businesses and how their business affects the environment and people.

With the introduction of the CSRD, the European Commission has taken a major step towards transparency. As awareness of the importance of ESG increases, regulations on companies become more stringent. Companies should assess whether they fall under the CSRD and start collecting and preparing the data relevant for the reporting as soon as possible.

authors: Alfred Amann, Alexandra Jelinek

co-authors