01 February 2023

roadmap

austria

"Mergers in Winter": Ethereum as eco-friendly blockchain

2022 was a difficult year for cryptocurrencies and other digital assets, with markets generally performing poorly, the collapse of terra luna, job cuts at almost all major exchanges, the bankruptcy of crypto hedge fund Three Arrows Capital and lending platform Celsius Network, and the stupendous collapse of FTX. On the positive side, the major blockchain Ethereum transitioned to proof-of-state consensus mechanism, officially reducing the energy consumption of the blockchain by ~99.95 %.

What was the Merge?

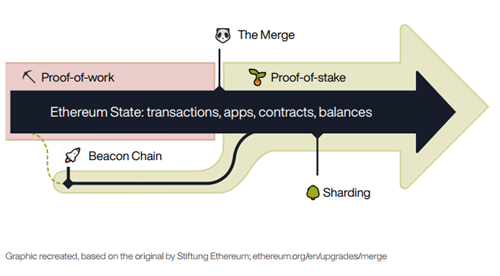

Technically, the Merge was the joining of the original layer of Ethereum with a new layer, called the Beacon Chain. This merger introduced the new proof-of-stake consensus mechanism to the blockchain, depreciating the initial proof-of-work consensus mechanism.

© Stiftung Ethereum; https://ethereum.org/en/upgrades/merge/

What is proof-of-stake?

A blockchain is a distributed database and requires a consensus mechanism to determine entries into it. Proof-of-stake (PoS) and proof-of-work (PoW) are two mechanisms used in various blockchains. Until the Merge, PoW was used by the most important blockchains, Bitcoin and Ethereum. PoW requires participants ("miners") to solve an arithmetic riddle by performing billions of arithmetic operations. These operations require an enormous and increasing amount of computing power. Bitcoin, for instance, is estimated to use 0.16 % of global energy production and emits 0.10 % of the world's carbon emissions as of Q3 2022. Despite improvements, the energy consumption is increasing.

PoS, in turn, is a mechanism based on the idea that those members on the blockchain who own the most tokens have an interest in keeping the network maintained. The decisive factor is therefore the stake of a user, i.e. the proportion of the total amount of tokens they own. The larger the stake, the more likely it is that this user will be selected to mine the next block. Broadly speaking, compared to proof-of-work, the proof-of-stake mechanism is more like a joint-stock corporation. Whoever owns a larger share in the company normally receives more voting rights entitling them to make decisions. PoS does not use energy to secure the network.

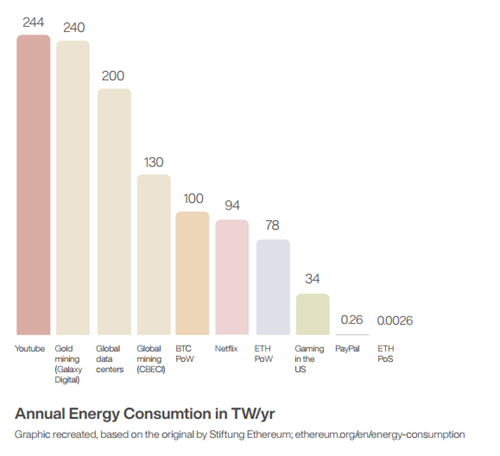

In the case of Ethereum, transitioning to PoS meant that the blockchain's energy consumption was reduced to ~0-0026 TWh/year. Estimates show that YouTube, for instance, used over 175 times more energy streaming the "Gangam Style" video in 2019 compared to what Ethereum uses per year. The following chart from the Ethereum website shows the estimated annual energy consumption in TWh/year for various industries (retrieved in June 2022; Ethereum is on the right end of the chart titled "ETH PoS"):

© Stiftung Ethereum; https://ethereum.org/en/energy-consumption/

How does PoS work?

Participants (node operators) must deposit 32 Ether (ETH) as collateral (via a smart contract – this is called "staking") to become network validators and receive rewards. One node is then chosen randomly as the recipient of the rewards. Via a staking pool, holders of Ether may pool their Ether holdings to participate in the PoS consensus process; the reward is then split between the pool participants. Many cryptocurrency exchanges (such as our client Bitpanda) offer staking solutions.

…and what happened then?

The Merge was a global event. It was successfully completed on 15 September 2022. Besides the effects on energy consumption, transactions are also expected to get faster, because PoS requires significantly fewer validations to be performed on the blockchain at the same time. This should also reduce transaction fees. It remains to be seen whether this thesis will uphold.

Despite the technical success of the Merge, the blockchain's cryptocurrency Ether (ETH), like almost all other cryptocurrencies and other digital assets, is still under pressure. At the time of writing (10 November 2022) it was trading at around EUR 1,000 per ETH, down from around EUR 3,300 at the beginning of the year. It remains to be seen if and when this crypto winter will melt into a crypto spring, and whether the Merge will be a commercial success for the network and its users.

author: Thomas Kulnigg

Thomas

Kulnigg

Partner

austria vienna