FDI screening was long a blank spot on the regulatory landscape for most countries in Central Eastern Europe (CEE). Unlike Western European Member States, relatively few countries in CEE had instruments to vet foreign investments and those that did exist often were of little practical consequence.

In view of the economic shockwaves from COVID-19, the European Commission (EC) highlighted the increased risk to strategic industries in the European Union in its Communication of 13 March 2020. It urged Member States "to be vigilant and use tools available to avoid that the current crisis leads to a loss of critical assets and technology" as a result of buyouts from foreign (i.e. non-EU/non-EEA) investors.

Subsequently, and ahead of the application of the EU FDI Screening Regulation, the EC specifically addressed the increased risk of attempts by foreign investors to acquire healthcare capacities. In light of this, the EC encouraged Member States to make full use of their existing FDI screening mechanisms or, where these are unavailable or inadequate, to set up a full-fledged screening mechanism.

National legislators in CEE have heard the wakeup call. Member States across the region have tightened or enacted new measures or initiated legislative processes to do so. These measures are largely shaped by the EU FDI Screening Regulation. Going forward, many foreign investments in critical sectors will have to undergo a vetting process.

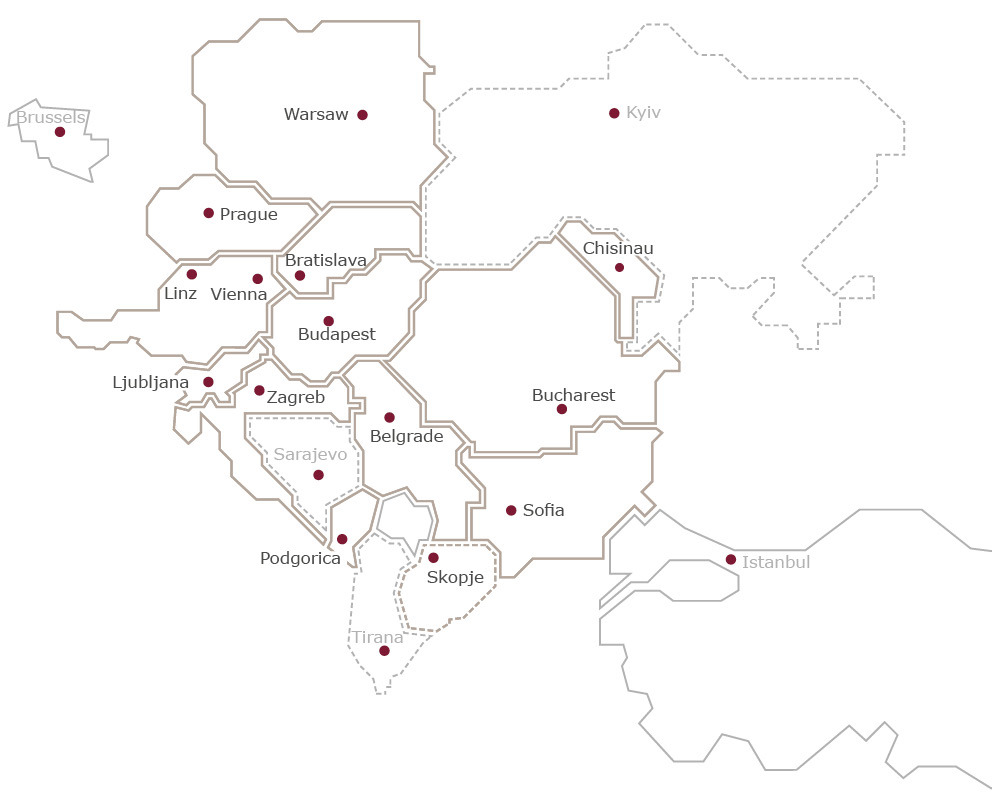

This booklet (now in its third edition) provides an up-to-date overview of the currently existing FDI regimes in CEE. Following the trend of tightening or setting up FDI screening mechanisms, besides Austria, the Czech Republic, Hungary, Moldova, Poland, Romania, Slovakia and Slovenia, this booklet now also covers the incoming regime in Bulgaria. In addition, it touches upon the investor screening regimes in Bosnia and Herzegovina, Croatia, Montenegro, North Macedonia and Serbia.

click on the map to jump to the country

austria

your contact persons: Volker Weiss, Evelin Hlina

Legal basis

Investment Control Act ("ICA"), OJ I No 87/2020, that entered into force in July 2020.

EU FDI Screening Regulation ((EU) 2019/452), OJ L 79I, 21 March 2019.

Filing requirement

A mandatory notification obligation is triggered if

- a foreign investor, i.e. a non-EU, non-EEA, non-Swiss individual or entity,

- invests (directly or indirectly) via the acquisition of

- voting rights of at least 10 % (in especially sensitive sectors; see below), 25 % or 50 %,

- control, or

- substantial/all assets (asset deals),

- in an Austrian undertaking that has its seat or central administration in Austria (local nexus),

- with activities in or related to a sensitive sector listed in the Annex to the ICA.

No approval is required for investments into micro-enterprises, i.e. undertakings with fewer than 10 employees and an annual turnover or balance sheet total of less than EUR 2m.

Relevant sectors

The sectoral scope of the Austrian FDI regime is very broad and covers all activities in or related to the areas listed in Parts 1 and 2 of the Annex to the ICA.

Part 1 contains an exhaustive list of especially sensitive areas (for which the 10 % voting right threshold applies). These are as follows:

- defence equipment and technologies;

- operating of critical energy infrastructure;

- operating of critical digital infrastructure (in particular 5G);

- water;

- operating of systems that enable data sovereignty of the Republic of Austria.

Part 2 contains an indicative list of other areas that are critical for public security and/or order, including:

- critical infrastructure, such as energy, IT, transport, health, food, telecommunications, defence, finance, etc.;

- critical technologies and dual-use goods, including AI, robotics, semiconductors, cybersecurity, quantum and nuclear technologies, nano or biotechnologies, etc.;

- security of the supply of critical resources, such as energy, raw materials, food, medicines, vaccines, ;

- access to sensitive information, such as personal data, or the ability to control such information; and

- the freedom and pluralism of the media.

Note: The sectoral scope criteria are given a wide reach in practice. For instance, undertakings active in one of the above-mentioned sub-infrastructure areas (e.g. telecommunications) or up- or downstream related sectors are presumed to have activities in the scope of the ICA.

Process and timetable

Competent authority: Federal Ministry of Labour and Economy (Bundesministerium für Arbeit und Wirtschaft)

Mandatory filing requirement: Yes

Filing deadline: No, but there is an obligation to file without undue delay after the signing of a contract or announcement of the intention to make a public offer.

Responsibility for filing: The obligation to notify rests primarily with the foreign investor (i.e. the acquirer). Additionally, the ICA foresees a reporting obligation in subsidiarity for the Austrian target undertaking. The Ministry can assume jurisdiction ex officio if it becomes aware of a transaction subject to approval that has not been notified.

Sanctions: Implementation ahead of local regulatory clearance is subject to criminal sanctions and/or administrative fines.

Length of the proceedings:

Phase 1: One month after an approx. 35-day (extendable) period for the EU Cooperation Mechanism within which the EU Commission and/or Member States can comment on the transaction (under the EU FDI Screening Regulation).

Phase 2: Two months.

more

further information

bulgaria

your contact persons: Ilko Stoyanov, Ema Stoyanova

Legal basis

Amendment to the Investment Promotion Act ("AIPA").

Regulation (EU) 2019/452 (the "EU FDI Screening Regulation").

The AIPA is set to become applicable in Q3 2024.

Filing requirement

The AIPA mandates the prior screening of any foreign direct investment that directly or indirectly originates from a non-EU controlled entity, which meets the following criteria:

- The investments exceeds EUR 2m, or

- The investments leads to an acquisition of at least 10 % ownership in an undertaking which achieves revenue in Bulgaria, or

- a non-EU state holds ownership or board seats in the foreign investor (with exceptions, incl. the USA, the UK, Canada, Australia, New Zealand, Japan, the Republic of Korea, the UAE and Saudi Arabia, and other "low-risk" states as determined by the Council of Ministers)

Certain investments (involving foreign investors from Russia or Belarus, or persons carrying out certain activities related to, inter alia, the production of petroleum-based products in relation to critical infrastructure), require always prior screening.

Further, as an exception, certain investments which otherwise would not meet the above trigger-criteria, but potentially impacting security or public order are also subject to screening.

Relevant sectors

The AIPA applies to investments in sectors outlined in Article 4, item 1 of the EU FDI Regulation, i.e.:

- critical infrastructure,

- critical technologies,

- supply of critical inputs,

- access to sensitive information and

- freedom and pluralism of the media.

It also covers investments by certain persons engaged in specific activities related, inter alia, to the production of petroleum-based products in the context of critical infrastructure.

Process and timetable

Competent authority: Council for Screening of Foreign Direct Investments (the "FDI Screening Council")

Mandatory filing requirement: Yes

Filing deadline: The investment must be notified before implementation.

Responsibility for filing: The foreign investor

Sanctions: Implementation ahead of local regulatory clearance is subject to a fine of 5 % of the value of the investment, though not less than about EUR 25,500.

Length of the proceedings:

The FDI Screening Council must issue a decision on the investment within 45 calendar days from the (complete) notification by the investor (may be extended by an additional 30 calendar days).

bosnia & herzegovina

your contact person: Danijel Stevanović

Bosnia and Herzegovina does not have a foreign investment screening regime comparable to those now emerging in the European Union in light of the EU FDI Screening Regulation. However, it operates an authorisation system covering the defence and media sectors.

Legal basis

Regulated on multiple levels due to the country's political and administrative structure:

- Bosnia and Herzegovina (state level) – Foreign Direct Investments in BiH Policy Act (Official Gazette of BiH, nos. 4/1998, 17/1998, 13/2003, 48/2010 and 22/2015) ("FDI Policy Act"), which sets out rules on the state level;

- FBiH - FBiH Foreign Investments Act (Official Gazette of FBiH, nos. 61/2001, 50/2003 and 77/2015), which sets rules in the entity of FBiH; and

- RS - RS Foreign Investments Act (Official Gazette of RS, no. 21/2018), which sets out rules in the entity of RS.

Filing requirement

Under the FDI Policy Act, a direct foreign investment is an investment into a newly established company/institution or into an existing domestic company/institution, which may be in cash, in-kind and in rights.

In addition, the RS Foreign Investment Act specifies the following forms of foreign investments:

- establishment of a legal entity fully owned by a foreign investor;

- establishment of a legal entity jointly owned by a foreign and domestic investor;

- investing into an existing legal entity;

- special forms of

The filing regime encompasses all transactions in the relevant sectors.

Relevant sectors

The defence sector, and in specific production (and sale in FBiH) of arms, ammunition, explosives for military use and military equipment, as well as the media sector, and in specific media activities (terrestrial broadcasting of TV and radio content).

Process and timetable

Competent authority: The state-level government, as well as:

- in the FBiH: Ministry of Energy, Mining and Industry (defence sector) and the FBiH Ministry of Traffic and Communications (media sector);

- in the RS, Ministry of Trade and Tourism and/or the RS Ministry of Energy and Mining (defence sector), and RS Ministry of Transport and Communications (media sector).

Mandatory filing requirement: Yes

Filing deadline: There is no deadline prescribed for the foreign investor to make the filing.

Responsibility for filing: The foreign investor is obliged to notify a foreign investment and procure its approval.

Sanctions: There are no specific penalties within the applicable rules.

Length of the proceedings: The government is obliged to decide on the proposal no later than 60 days after the date of receipt of the complete request.

croatia

your contact person: Ana Mihaljević

Legal basis

Regulation on the implementation of the EU FDI Screening Regulation (Regulation (EU) 2019/452), OJ L 79I, 21 March 2019 ("Implementing Regulation"). The Implementing Regulation entered into force on 2 October 2020.

Croatia is currently implementing a project with the OECD that is expected to result in recommendations for the design of a national investment screening mechanism. Up to this point, no formal legislative activities have been undertaken.

Filing requirement

There is so far no FDI filing screening regime. However, the Implementation Regulation establishes the National Contact Point (Nacionalna kontaktna točka) and the Interdepartmental Commission (Međuresorno povjerenstvo), which will act as a competent authority for the EU cooperation mechanism under the EU FDI Screening Regulation. The regulation does not foresee a mandatory screening instrument.

The National Contact Point is vested with the power to request information from a foreign investor making an investment in the Republic of Croatia or an undertaking located in the Republic of Croatia in which an FDI is planned to be made. The foreign investor or Croatian undertaking must submit the requested information to the National Contact Point within seven days of receiving the request.

The main tasks of the Interdepartmental Commission are to coordinate interdepartmental cooperation and the efficient flow of information between state and public administration bodies involved in the implementation of the EU FDI Screening Regulation and to provide expert assistance to the National Contact Point on all issues related to it, in particular through the preparation of proposals, opinions and expert explanations.

In addition, there is a reporting duty to inform the Croatian National Bank of the investment within 30 days from the end of the month in which the investment was made (for statistical purposes).

Process and timetable

Competent authority: National Contact Point and Interdepartmental Commission.

Mandatory filing requirement: No screening mechanism in place.

Filing deadline: No screening mechanism in place.

Responsibility for filing: No screening mechanism in place.

Sanctions: N/A

Length of the proceedings: N/A

czech republic

your contact person: Jan Kupčík

New FDI legislation entered into force on 1 May 2021. It introduced a mandatory, suspensory, pre-closing notification obligation for acquisitions of "effective control" over companies active in the Czech Republic in industries deemed capable of threatening the security of the Czech Republic and internal or public order by parties resident outside the European Union, or whose ultimate controlling parent is resident outside the European Union.

Mandatory notifications can take the form of either (i) a mandatory FDI filing or (ii) a mandatory FDI consultation. In addition, the authority has a call-in power with respect to foreign investments into non-sensitive industries. To avoid uncertainty, a foreign investor can also make use of a voluntary consulting procedure for such investments.

Legal basis

Act No. 34/2021 Coll., on Foreign Investment Screening and Amendments to Related Legislation (the "Act"), which entered into force on 1 May 2021. EU FDI Screening Regulation (Regulation (EU) 2019/452), OJ L 79I, 21 March 2019.

Filing requirement

The notification obligation is triggered if a foreign investor, i.e. a non-EU individual/entity, an individual/entity directly or indirectly controlled by a non-EU individual/entity, or a trustee of a trust fund provided that the person who set up the trust or who in any way actually exercises influence over the trust (i.e. the person appointed by or approved by the trustee) or in whose benefit the trust was established is a non-EU individual/entity or an individual/entity directly or indirectly controlled by a non-EU individual/entity, intends to make an investment of any form with the aim of carrying out economic activity in the Czech Republic, which enables the exercise of an effective degree of control in a target undertaking active in the Czech Republic. An effective degree of control is to be understood as:

- acquisition of at least 10 % of voting rights or the possibility to exercise a corresponding influence in the target undertaking;

- membership in the target undertaking's corporate bodies;

- ownership of an asset through which the economic activity is performed; or

- ability to gain access to information, systems

or technologies that are deemed important in relation to the protection of the Czech Republic's security and internal or public order.

Mandatory filings and mandatory consultations are triggered if the above requirements are met and the investment is directed to one of the sensitive sectors. A voluntary consulting procedure is available to all investments meeting the above criteria outside the sensitive sectors.

Relevant sectors

Sensitive activities include:

- production, research, development, innovation or ensuring the lifecycle of military material (listed in the EU Military Material List);

- critical infrastructure subjects designated as such by an administrative authority (such as energy, gas, heat and water management, food and agriculture, healthcare, transportation, communication and IT systems, financial markets, emergency services and public administration);

- provision of regulated services in the higher regime under Cybersecurity Act;

- development and production of dual-use products listed in Annex IV of the EU Dual-Use Regulation 2021/821.

Should the investment concern the media sector, the Act provides for a mandatory consultation if the target undertaking holds a licence for nationwide radio or television broadcasting or if the target undertaking is a publisher of periodicals with a minimum daily average of 100,000 printed copies in the last calendar year.

Foreign investments which do not fall within the above categories can be screened ex officio up to five years after closing, unless the investor makes use of the voluntary consultation procedure.

Process and timetable

Competent authority: Ministry of Industry and Trade

Mandatory filing requirement: Yes (for sensitive sectors)

Filing deadline: An investment requiring a mandatory filing cannot be implemented prior to obtaining approval.

Responsibility for filing: The direct foreign investor is responsible for obtaining the necessary approval.

Sanctions: Implementation ahead of local regulatory clearance is subject to administrative fines.

Length of the proceedings: Consultation: 45 days (obligatory for media sector) Unconditional approval: 90 days (+30 days) Conditional approval / Rejection: > 90 days (+30 days)

hungary

your contact persons: Kinga Hetényi, Adrian Menczelesz

Legal basis

Two parallel FDI screening mechanisms now apply in Hungary

(New foreign investments screening rules in Hungary):

1. Approval by the Minister of the Prime Minister's Cabinet Office

Act No. LVII of 2018 on the Control of Investments Detrimental to the Interests of Hungarian National Security (the "Act").

Government Decree No. 246/2018 (XII. 17.) on the execution of Act No. LVII of 2018 ("Decree 246/2018").

Government Decree No. 129/2023 (IV. 17.) on emergency rules for the sale of the debtor in order to continue its business activity in winding-up proceedings.

Hereinafter referred to as "MCO FDI Screening".

2. Approval by the Ministry of National Economy

Act No. L of 2025 on "on raising the emergency decrees issued in view of the armed conflict in Ukraine to the level of law" effective until 31 December 2026 ("Act 2025").

Hereinafter referred to as "MNE FDI Screening".

EU FDI Screening Regulation (Regulation (EU) 2019/452), OJ L 79I, 21 March 2019.

Filing requirement

1. MCO FDI Screening

MCO FDI Screening applies to (i) investors from outside the EU, Switzerland and EEA, and to (ii) any subsidiary of such an investor if the subsidiary is established in the EU, Switzerland or an EEA member state and the investor holds a majority of the voting rights in the subsidiary or has a decisive influence in it. The foreign investor must obtain the prior approval of the Minister of the Prime Minister's Cabinet Office if it intends to:

- directly or indirectly acquire more than a 25 % interest in an existing or yet to be established company with its registered seat in Hungary (and in the case of a publicly listed company, more than a 10 % interest), provided that this company pursues activities that are deemed to be sensitive for national security ("Hungarian Company");

- acquire decisive influence in a Hungarian Company;

- establish a branch office in Hungary; or

- acquire a right to operate or use sensitive infrastructure or assets in Hungary.

All transactions that result in a foreign investor acquiring more than a 25 % interest in a Hungarian Company are subject to foreign investment screening. Moreover, prior approval is required when a foreign investor acquires an interest of less than 25 % but this acquisition results in more than a 25 % interest in the respective Hungarian Company being held by several foreign investors.

2. MNE FDI Screening

Under Act 2025, approval by the Ministry of National Economy is required for investments by foreign investors acquiring (i) an interest exceeding 5 % or 3 % in the case of a publicly listed company and a value of HUF 350m (approx. EUR 1m), (ii) a 10 %, 20 % or 50 % interest irrespective of its value, or (iii) an interest as a result of which a more than 25 % interest will be held by several foreign shareholders. Furthermore, the foreign investor must obtain approval from the Ministry of National Economy if it intends to acquire the right to use or operate infrastructure necessary for pursuing activities in strategic sectors, including the acquisition of a security interest over such strategic infrastructure.

A "foreign investor" is (a) a company or organisation domiciled in, or a citizen of, a state outside of the EU, the EEA or Switzerland, or (b) a company or organisation whose majority owner is either domiciled in, or a citizen of, a state outside of the EU, the EEA or Switzerland. However, certain acquisitions of at least a majority interest require approval by the Ministry of National Economy if the foreign investor is a company or other organisation domiciled in the EU, the EEA or Switzerland. Act 2025 applies to investments in companies that have their seat in Hungary and:

1. are a limited liability or private limited or public (listed) company; and

2. operate in specified "strategic" sector.

Nevertheless, Act 2025 is not applicable to a transaction that directly affects only a foreign company, where Act 2025 was applicable only because the foreign company has a Hungarian subsidiary that qualifies as a strategic company. Therefore, transactions above the level of a Hungarian subsidiary (qualifying as a strategic company), do not require approval by the Ministry of National Economy.

Relevant sectors

1. MCO FDI Screening

The Act contains a complex system regarding the sectors and activities which are under scrutiny. These activities in the specific sectors include activities that:

- are traditionally considered sensitive, g. manufacturing of arms, ammunition, dual-use items and secret service equipment;

- fall under the Hungarian Gas Act, Water Supply Act, Electricity Act or the Electronic Communications Services Act; or

- are considered sensitive based on other reasons, e.g. involvement in the creation, development or operation of communication systems of the Hungarian State and Hungarian municipalities, certain insurance and re-insurance services or services directly linked thereto, operation of the central credit information system, operation of certain payment systems.

2. MNE FDI Screening

"Strategic" sectors such as manufacturing of medicines, medical devices or other chemicals, fuel production, telecommunications, retail and wholesale (including motors and cars), manufacturing of electronic devices, machinery, steel and vehicles, defence industry (e.g. manufacturing and trade of arms and ammunition as well as technologies used for military purposes), power generation and distribution, services connected to the state of emergency, financial services (including insurance, brokering and other services), processing of food (including meat, milk, grains, tobacco, fruits and vegetables), agriculture, transport and storage, construction (including the production of building materials), healthcare, tourism (hospitality and cafeteria services), waste management and others (e.g. dam construction, higher education services, activities in relation to critical raw materials). Special provisions apply to certain Hungarian companies active in the solar energy sector, as the Hungarian state has a first-ranked pre-emption right in such acquisitions.

Process and timetable

1. MCO FDI Screening

Competent authority: Minister of the Prime Minister's Cabinet Office

Mandatory filing requirement: Yes

Filing deadline: The foreign investor must file for approval within 10 days from (i) the date of execution of the underlying agreement, preliminary agreement or undertaking, or (ii) the date when the respective commercial registry registers the change of activity of a strategic company.

Responsibility for filing: The foreign investor and its management (as the acquirer) are responsible for obtaining the necessary approval.

Standstill requirement: Yes

Sanctions: Implementation of the transaction ahead of local regulatory clearance is subject to (i) fines under Decree 246/2018, and if the Ministry prohibits the transaction (ii) invalidity of the underlying agreement(s) and corporate actions (e.g. shareholders' resolution). In addition, the foreign investor must (iii) sell its shares or eliminate its influence in the Hungarian Company, or the Hungarian Company must modify its activity, or the foreign investor must close its branch, within three months.

Length of the proceedings:

60 calendar days, which may be extended by an additional 60 calendar days.

2. MNE FDI Screening

Competent authority: Ministry of National Economy

Mandatory filing requirement: Yes

Filing deadline: The request for the approval must be made within 10 days from the execution of the underlying agreement.

Responsibility for filing: The foreign investor and its management (as the acquirer) are responsible for obtaining the necessary approval.

Standstill requirement: Yes

Sanctions: Implementation of the transaction ahead of local regulatory clearance is subject to (i) fines under Act 2025, and if the Ministry of National Economy prohibits the transaction (ii) invalidity of the underlying agreement(s) and corporate actions (e.g. shareholders' resolution).

Length of the proceedings:

30 business days, which may be extended once by an additional 15 calendar days.

In the case of an acquisition of a Hungarian company active in the solar energy sector, the deadline is longer, as the Hungarian state may exercise a first-ranked pre-emption right over such a Hungarian company within 90 business days from the day on which the Ministry of National Economy has received the complete application for the FDI approval and has established and informed the foreign investor that such a pre-emption right actually applies.

moldova

your contact person: Vladimir Iurkovski

Legal basis

Law on the examination mechanism of investments of importance for state security (the "FDI Law") No 174/2021 dated 11 November 2021.

Filing requirement

The notification obligation is triggered:

- if any natural or legal person intends to carry out an investment by any means, directly or indirectly, individually or jointly, including as ultimate beneficial owner(s) in a Moldovan area of significance for state security. This includes:

- by the acquisition of control, the acquisition or increase of a "qualified participation", in a company active in areas of significance for state security (including in a company that invests in companies active in these areas);

- by the entry into certain types of concession agreements, e. (i) works concession contract or a service concession contract, and (ii) concessions in the field of defence and state security;

- by the entry into a public-private partnership agreement relating to "assets of national security significance" or falling within areas of significance for state security;

- by the entry into investment agreements with the Moldovan Government relating to "assets of national security significance" or falling within areas of significance for state security;

- by the entry into a sale and purchase agreement in relation to assets representing at least 25 % of the value of the assets of companies already investing in areas of significance for state security; or

- by the entry into financial transactions (loans/credits or subsidies) between a company already investing in areas of significance for state security and persons from other states that are directly or indirectly controlled by the governments of other states.

The FDI Law does not provide for a financial threshold from which the transactions in question would fall within its scope.

No approval is required for an investment carried out by an undertaking from the financial sector as well as those involving international financial institutions.

Relevant sectors

The FDI Law defines the relevant sectors through the following exhaustive list:

- hydrometeorological and geophysical field;

- radioactive waste management; operation of energy (including electric energy, natural gas and petroleum products), transport, water and sewerage, aerospace, defence, election infrastructure;

- exploitation of artificial intelligence technologies, robotics, semiconductors, cybersecurity, aerospace, defence technologies, quantum and nuclear technologies, nanotechnologies and biotechnologies;

- production of means of cryptographic protection for information;

- production and acquisition for the purpose of resale of means of protection of information classified as a state secret;

- production of explosive materials for industrial use and their distribution activities;

- aviation security activities;

- design, production, maintenance and operation of aircrafts, including unmanned aircrafts, and of their components;

- design, production, maintenance and operation of systems and components used in air traffic management and provision of air navigation services;

- design, maintenance and operation of airports and heliports, including the safety-relevant equipment used on them;

- management of airports, bus stations, rail traffic, inland waterways, ports and quays for waterway traffic;

- television broadcasts / audio-visual services;

- provision of fixed or mobile electronic communications networks and/or services;

- supply of services in national ports;

- geological exploration and/or exploitation of mineral deposits;

- production, export, re-export, import of weapons, ammunition and military equipment; products, technologies and services that can be used in the manufacture and use of nuclear, chemical, biological and missile weapons; and

- administration of public registers of the state, information security.

The FDI Law also provides a filing requirement in relation to assets of national security significance. The list of assets of national security significance is exhaustive and approved by the government decree.

Process and timetable

Competent authority: Council for the promotion of investment projects of national importance

Mandatory filing requirement: Yes

Filing deadline: Prior to carrying out investment activities in areas of significance for state security.

Responsibility for filing: The responsibility for filing remains with the potential investor or foreign acquirer.

Sanctions: Entering into or carrying out transactions without the prior approval of the Council may lead to the Council's decision to (i) request the termination of the agreement or transaction and the reparation of the damage caused, regardless of the law applicable to the agreement or transaction; (ii) suspend the investor's voting right, right to summon a general meeting of shareholders, right to include questions on the agenda of the general meeting of shareholders, right to propose members to management bodies, right to receive dividends / net income, etc., and (iii) order the management to annul the target's issued shares and order the issuance of new shares, which will become Moldovan company treasury shares, which would need to be transacted (sold) in line with the applicable legislation (including while observing the FDI Law).

Length of the proceedings: The Council will examine the request within 45 days of the date of its receipt. The term can be suspended within up to 20 days should the potential investor have to add missing documents to the filing.

Consecutive (later) changes to the UBO structure of the investor: Whenever new circumstances relating to its UBO occur, the investor is obliged to inform the Council thereof at its own initiative, even if this investor's investments were previously approved by the Council. During the analysis of the new circumstances, the Council has the right to request documents or information in relation to the new structure and suspend any previously issued approval. If, after conducting the verification, the Council reaches the conclusion that the new investor (through its UBO or UBOs) does not meet the requirements of the law, it may notify the investor and, within 60 days as of the date of such notification, order the sale of the participation or the annulment of the historical transaction.

Likewise, reporting entities in the field of money laundering in Moldova are obliged to inform the Council about changes to the UBO structure (banks, attorneys, notaries), i.e. to inform the Council about the investor's changes to the UBO structure if such changes differ from the UBO structure previously registered in the State Register of Legal Entities from Moldova.

montenegro

your contact person: Danijel Stevanović

Montenegro does not have a foreign investment screening regime comparable to those emerging now in the European Union in light of the EU FDI Screening Regulation. It operates a sector-specific authorisation system covering the defence sector.

Legal basis

The Foreign Investments Act (Official Gazette of Montenegro, nos. 18/11, 45/14 and 73/19) and the Guidance on the content and the manner of submitting information on foreign investments (Official Gazette of Montenegro, no. 19/14).

Filing requirement

A foreign investment is defined by the Foreign Investments Act as an investment in-cash, in-kind, services, property rights and securities (with in-cash and in-kind investments qualified as such in accordance with Montenegrin accounting rules). The Foreign Investments Act explicitly provides that a foreign investor can:

- establish a company (solely or with other investors);

- establish a branch of a foreign company;

- acquire shares and stock in a Montenegrin company; and

- acquire a Montenegrin

In addition, the Foreign Investments Act foresees that a foreign investment can be made based on concession agreements, franchising agreements, financial leasing agreements and real estate purchase agreements, as well as other agreements in accordance with applicable laws.

A foreign investment is subject to screening and approval only if it concerns an investment into or the incorporation of a company active in the production and trade of arms and military equipment.

Relevant sectors

Production and trade of arms and military equipment.

Process and timetable

Competent authority: Ministry of Economic Development, Ministry of Defence and Ministry of the Interior.

Mandatory filing requirement: Yes

Filing deadline: There is no deadline prescribed for the foreign investor to make a filing.

Responsibility for filing: The foreign investor is obliged to notify a foreign investment and procure approval for it.

Sanctions: There are no prescribed sanctions under the current framework applicable to foreign investments in the field of production and trade of arms and military equipment. However, approval is mandatory when the conditions are met, and closing must be suspended until approval is obtained. Moreover, a Montenegrin company engaged in the production and trade of arms and military equipment cannot negotiate a foreign investment in any of the forms described above before obtaining approval from the Ministry of Economic Development.

Length of the proceedings: There is no deadline prescribed for the Ministry of Economic Development to carry out its review and issue a decision.

north macedonia

your contact person: Danijel Stevanović

North Macedonia does not have a foreign investment screening regime comparable to those now emerging in the European Union in light of the EU FDI Screening Regulation, but operates a single-sector authorisation system specifically covering the defence sector. In addition, all direct investments made by non-residents are subject to mandatory registration.

Legal basis

The Foreign Exchange Operations Act (Official Gazette of RM, nos. 34/2001, 49/2001, 103/2001, 51/2003, 81/2008, 24/2011, 135/2011, 188/2013, 97/2015, 153/2015, 23/2016, and Official Gazette of RNM, no. 110/2021) and the Act on Development, Production and Trade of Military Goods (Official Gazette of RNM, no. 298/21).

Filing requirement

The filing regime in the defence sector encompasses investments by a foreign legal entity into a company active in the development and production of military equipment.

Regarding the mandatory registration of direct investments, which is administrative or statistical in nature, the following is considered a direct investment according to the Foreign Exchange Operations Act:

- incorporating a company or increasing the registered capital of a company in full ownership of the investor, establishing a subsidiary or acquiring full ownership over an existing company;

- participation in a new or already existing company if the investor holds or acquires more than a 10 % share in the registered capital of the company, exceeding 10 % of the voting rights;

- a long-term loan of five or more years of maturity, if the loan from the investor is intended for a company that it owns in full; and

- a long-term loan with five or more years of maturity, if the loan is intended to establish lasting economic relations if granted among entities associated in a mutual economic venture.

Relevant sectors

Approval is necessary for all foreign investments that concern investments into a company active in the development and production of military equipment.

Registration is mandatory for all direct investments as defined above, as well as for modifications of existing investments.

Process and timetable

Competent authority: Ministry of Economy for investments into the defence sector. Registration is carried out by the Registry for Direct Investments ("RDI").

Mandatory filing requirement: Yes

Filing deadline: There is no deadline prescribed for the submission of a request to the Ministry of Economy. The deadline for notifying a direct investment is 60 days from the date of the transaction that constitutes the legal basis for making the direct investment.

Responsibility for filing: The responsibility for making a filing regarding investments in the field of development and production of military equipment lies with the foreign investor. The obligation to register the foreign direct investment lies upon the resident company in which the foreign investor has invested.

Sanctions: Failure to obtain approval for investments in the field of development and production of military equipment entails the following penalties:

- EUR 4,000 to EUR 8,000 for a resident who enables a foreign investment without previous approval from the Ministry of Economy;

- EUR 500 to EUR 1,000 for the responsible person within the resident company;

- a one- to five-year ban on carrying out production and trade of military equipment for the company, i.e. a one- to five- year ban for the responsible person; and

- confiscation of the objects with which the misdemeanour was committed.

Failure to register a direct investment with the RDI entails the following penalties:

- a fine ranging from EUR 250 to EUR 15,000 for the resident company;

- a fine ranging from EUR 100 to EUR 800 for the manager of the resident company.

Also, the transfer of profit, as well as the transfer of funds generated from the sale of shares held in the Macedonian company (or its liquidation), is conditioned by previous appropriate registration of the foreign investment with the RDI.

Length of the proceedings: Regarding investments into the defence sector, the Ministry of Economy is obliged to carry out the review and issue a decision at the latest within 60 days from the date of a complete request. There is no deadline prescribed for the RDI to issue a decision.

poland

your contact persons: Paweł Kułak, Krzysztof Pawlak

Legal basis

Act of 24 July 2015, on Control of Certain Investments (the "Act", OJ 2023, item 415.

The Act provides for two separate sets of rules related to different investors, with other companies and sectors protected, different competent authorities, separate procedural rules and fines. Both sets of rules are presented below as "FDI 1" and "FDI 2".

Filing requirement

FDI 1:

The notification obligation is triggered if an investor (regardless of its nationality or place of registered seat) intends to carry out an investment (i.e. acquisition of an undertaking or its organisational part, acquisition of shares in an undertaking or acquisition of control over an undertaking) in an undertaking that is active in a sector affecting the public security and/or public order of Poland.

FDI 1 covers the acquisition of a "significant participation", which is defined as a shareholding conferring at least 20 %, 25 % or 33 % of the voting rights in the target entity.

FDI 2:

The notification obligation is triggered if a foreign investor (an individual/entity without EU, EEA or OECD citizenship/registered office) intends to carry out an investment (i.e. acquisition of an undertaking or its organisational part, acquisition of shares in an undertaking or acquisition of control over an undertaking) in an undertaking with its registered seat in Poland that achieved domestic revenues exceeding EUR 10m in any of last two years and is covered by FDI 2.

Under FDI 2 a minority shareholding that does not confer control can be subject to investment screening, though acquisitions of a shareholding below 20 % are exempted.

Relevant sectors

FDI 1:

The Act can be applied to companies operating in 15 strategic sectors of the Polish economy, for instance:

- power generation and distribution;

- gasoline and diesel production, transport and storage;

- production of chemicals and fertilisers;

- telecommunications;

- manufacture and trade of arms, ammunition and military technologies, etc.

A list of companies active in strategic sectors covered by the regulation is published by the Council of Ministers. As of 1 January 2024 it includes 17 companies.

FDI 2:

FDI 2 applies to targets which:

- are publicly listed companies; or

- own assets defined as critical infrastructure under Polish law; or

- develop or modify software for specific sensitive use, such as to control power plants or networks, to operate facilities or systems for the supply of utilities, to operate equipment or systems used for voice and data transmission or for storage and processing, to operate or manage facilities or systems used for cash supply, card payments, conventional transactions, securities settlement and derivative transactions, to provide insurance services, or to operate transport systems or facilities; or

- operate in selected sensitive sectors, such as telecommunications, power generation and distribution, fuel production, transport and storage, production of chemicals, manufacturing of medicines or medical devices, processing of meat, milk, grains, fruits and vegetables, manufacturing and trade of arms and ammunition as well as technologies used for military purposes, etc.

Process and timetable

Competent authority: Ministry of State Treasury, Ministry of Defence or Ministry of Maritime Economy (depending on the sector in which the protected undertaking operates) for FDI 1, and the President of the Office for Competition and Consumer Protection for FDI 2.

Mandatory filing requirement: Yes (for both FDI 1 and FDI 2)

Filing deadline: A relevant agreement needs to be reported prior to the signing of a contract or publication of a public offer to the relevant authority (for both FDI 1 and FDI 2).

Responsibility for filing: The investor (as the acquirer) is responsible for obtaining the necessary approval. In certain cases, the protected undertaking is obliged to submit the notification (e.g. if the acquisition of significant participation is a result of redemption of shares of the protected entity, demerger or amendments to the agreement or statutes of the protected entity with respect to the preference of shares) (for both FDI 1 and FDI 2).

Sanctions: Implementation ahead of local regulatory clearance is subject to criminal sanctions, i.e. a fine of up to PLN 100m (approx. EUR 24m) and/or imprisonment of six months to five years for FDI 1. For FDI 2, the respective sanctions are a fine of up to PLN 50m (approx. EUR 12m) or imprisonment of six months to five years.

Length of the proceedings: 90 days (FDI 1).

FDI 2:

Phase 1: 30 business days

Phase 2: 120 calendar days

romania

your contact persons: Georgiana Bădescu, Cristiana Manea

Legal basis

Emergency Government Ordinance No. 46/2022 on measures to implement Regulation (EU) 2019/452 of the European Parliament and of the Council of 19 March 2019 establishing a framework for the examination of foreign direct investment in the Union, as well as for the amendment and completion of Competition Law No. 21/1996 (amended in June 2023, via Law No. 164/2023 and in December 2023, via Emergency Ordinance No. 108/2023).

Regulation on the organisation and functioning of the Commission for the Examination of Foreign Direct Investments, approved via Government Decision 1.326/2022.

National Defence Council Decision No. 73/2012. Competition Law No. 21/1996 and the Merger Control Regulation, as approved by Order of the Romanian Competition Council Chairman No. 431/2017.

EU FDI Screening Regulation (Regulation (EU) 2019/452), OJ L 79I, 21 March 2019.

Filing requirement

Criteria for triggering the FDI filing:

- the investment must occur in certain sectors deemed sensitive from a national security standpoint; and

- the investment must have a value exceeding EUR 2m, although even transactions below this value may be screened if they are likely to trigger potential risks or effects for national security or public order.

Note: The nationality of the investor is irrelevant. Both non-EU and EU investors (including Romanian investors) will need to file their investments in sensitive sectors.

Foreign direct investments can consist in:

- changes in control in the ownership structure and/or effective participation to the management of a company; and/or

- an investment of any kind made by a foreign (non-EU) and/or EU investor for the purpose of establishing or maintaining long-lasting and direct links between the investor and an undertaking, via (a) funds which are made available for carrying out an economic activity in Romania, and (b) which allow the investor to exercise control over the management of the business;

- greenfield investments and/or extensions of current capacity productions, diversifying the production or otherwise making significant changes to the current production processes (i.e. "new" investments).

Note: Internal reorganisations may also fall under the regime, on a case-by-case basis. Reviews are primarily conducted for transactions where a non-EU entity is interposed in the ownership chain above a Romanian entity. In practice, the FDI authority has also reviewed intra-EU internal reorganisations under a so-called "fast-track" process, which enables the authority to issue non-intervention (non-jurisdiction) letters, as needed.

- Exclusions from the scope: portfolio investments, consisting in (a) acquisitions of shares on stock exchanges which (b) do not lead to any direct involvement in the management of the company.

Relevant sectors

The investment must take place in one of the following domains (deemed of strategic importance for national security):

- security of citizens and communities;

- border security;

- energy security;

- transport security;

- supply of vital resources security;

- critical infrastructure security;

- security of IT and communication systems;

- security of financial, tax, banking and insurance activities;

- security of weapons, munitions, explosives, toxic substances manufacturing and circulation;

- industrial security;

- protection against disasters;

- protection of agriculture and environment;

- protection of state-funded companies or of their management during privatisation.

The above sectors will be reviewed in conjunction with the sensitive areas defined by the EU FDI Regulation.

Investments in media companies

Transactions concerning companies (i) with audio-visual licences or that (ii) issue publications with an average of at least 5,000 printed copies per day in the last calendar year or that (iii) have a web portal with a minimum of 10,000 views per month are bound to special transparency rules. Such transactions will be subject to a public consultation process of a minimum 30 calendar days.

Process and timetable

Competent authority: FDI Screening Commission (via the Romanian Competition Council)

Mandatory filing requirement: Yes

Filing deadline: N/A (from a practical perspective, filing should occur as close as possible to the transaction signing date). The FDI regime applies to all "ongoing transactions", including investments in relation to which the parties announced their intention to conclude an agreement (e.g. via a preliminary agreement, MoU or LoI).

Responsibility for filing: Investor(s) gaining sole or joint control and/or gaining effective participation in the management of a company or making a "new" investment.

Standstill requirement: Yes

Sanctions: Fines of up to 10 % of the total worldwide turnover for (i) gun-jumping, (ii) providing inaccurate or misleading information, or (iii) failure to observe the commitments set in a conditional clearance decision.

Length of the proceedings:

Phase 1: Non-conditional clearance is expected in principle within 135 calendar days as of the date when filing is deemed complete (requests for information stop the clock).

Phase 2: This will involve, inter alia, the approval of the National Defence Council, which adds another 90 calendar days to the review process. Other approvals may also be required, on a case-by-case basis.

The timeline applicable in case of conditional clearances or rejection decisions is not transparent, as these can only be made via a government decision.

Note: Filings are subject to a screening fee of EUR 10,000, payable upon submission. Payment must be made in local currency (RON), according to the National Bank of Romania's exchange rate available on the last day of the month prior to the submission.

The screening fee can be returned to the investor if the authority finds that the investment does not meet the requirements for an FDI screening.

serbia

your contact person: Danijel Stevanović

Serbia does not have a foreign investment screening regime comparable to European regimes shaped by the EU FDI Screening Regulation. Rather, Serbia operates a single-sector authorisation system covering the defence sector.

Legal basis

The Production and Trade of Arms and Military Equipment Act (Official Gazette of Serbia No. 36/2018).

Filing requirement

A foreign investment in the field of arms and military equipment manufacturing is defined by the Arms Act as an investment of capital by a foreign investor by way of:

- establishing a company active in the manufacturing of arms and military equipment, either independently or with another domestic or foreign natural or legal person or with the Republic of Serbia;

- recapitalisation of a company active in the manufacturing of arms and military equipment; or

- purchase of capital of a company active in the manufacturing of arms and military equipment.

In this sense, a company active in the manufacturing of arms and military equipment means a company incorporated in Serbia and holding an appropriate licence to produce these items.

All transactions falling under the above criteria need to be notified for foreign investment screening and approval.

Relevant sectors

The current foreign investment screening regime in Serbia is limited to the defence sector, specifically to foreign investments in the production of arms and military equipment.

Process and timetable

Competent authority: Ministry of Defence and the Serbian government

Mandatory filing requirement: Yes

Filing deadline: There is no filing deadline, but the process of changing ownership over a company active in the production of arms and military equipment cannot be initiated without prior approval.

Responsibility for filing: The foreign investor is obliged to notify a foreign investment and to procure its approval.

Sanctions: The Arms Act provides for penalties if a change of ownership is initiated without the required approval. The range of penalties is approximately EUR 4,200 – 6,000 (RSD 500,000 – 750,000) for companies and EUR 420 – 600 (RSD 50,000 – 75,000) for responsible individuals.

Length of the proceedings: Upon receipt of the request by the Ministry of Defence, the government must issue its decision (which will be based on a proposal of the Ministry of Defence) within 120 days from the date of receipt of the request.

slovakia

your contact person: Michal Lučivjanský

New investment screening legislation entered into force on 1 March 2023. Under the new FDI regime, certain direct or indirect investments by foreign investors into Slovak entities must be notified and are subject to approval by the Ministry of Economy of the Slovak Republic.

Legal basis

Act No. 497/2022 Coll., on Screening of Foreign Investments, as amended ("FDI Act"), entered into force on 1 March 2023. Regulation No. 61/2023 Coll., laying down critical foreign investments, as amended, also entered into force on 1 March 2023.

Filing requirement

The FDI Act recognises:

- mandatory filing – triggered if a foreign investor intends to make an investment in a Slovak target active in a critical sector;

- voluntary filing – possible if a foreign investor intends to make an investment in a Slovak target active in a non-critical sector;

- ex officio screening – the authority may call in a transaction up to two years after implementation of the transaction for non-critical investments. There is no limitation period for investments in critical sectors.

The notification obligation is triggered if a foreign investor, i.e. a non-EU individual or entity or an EU individual or entity that is controlled, financed or acts in concert with a non-EU individual or entity, a public authority of a third country, or an entity with the equity participation of a third country, intends to carry out an investment (directly or indirectly) in a Slovak target. This includes:

- the acquisition of a target's business (asset deal);

- the acquisition of a participation in a target (share deal), meaning at least 25 % shareholding/voting rights for a non-critical investment or 10 % for a critical investment;

- the increase of a participation in a target, the relevant thresholds being 50 % for a non-critical investment and 20 %, 33 % or 50 % for a critical investment;

- acquisition of control over a target by other means (e.g. by controlling the composition of corporate bodies).

In addition, greenfield investments in the form of the establishment of a new company, as well as certain financing deals, such as the creation of a pledge over shares or assets of a Slovak company, can also qualify as a foreign investment if the pledge agreement grants specific rights to the pledgee in relation to the business decisions of that company, and thus trigger FDI screening.

Relevant sectors

A transaction falls under the mandatory regime if the Slovak target is active in:

- manufacturing firearms, parts, ammunition, optical instruments, explosives, pyrotechnic products or devices for jamming electronic signals;

- manufacturing, providing certain services or conducting research, development or product innovation for military/defence or dual-use equipment;

- manufacturing, research, development or innovation in the biotechnology industry in healthcare;

- operating a critical infrastructure element;

- operating an essential service;

- providing cloud services, while employing at least 50 employees and generating annual revenues or a total annual balance sheet of more than EUR 10m;

- the manufacture, research, innovation or development of cryptographic devices or components certified in the Slovak Republic or holding such devices; or

- the media sector in certain categories.

A transaction can fall under the voluntary regime if the economic activity performed by the Slovak target falls outside the above categories.

Process and timetable

Competent authority: Ministry of Economy and the Slovak government

Mandatory filing requirement: Yes, for critical investments.

Filing deadline: A notification falling under the mandatory FDI screening regime must be filed before closing. Until the transaction is approved, the standstill obligation applies. A voluntary notification must also be filed before closing, but closing can take place even if the FDI proceedings have not finished yet.

Responsibility for filing: The notification obligation lies with the foreign investor (i.e. the actual acquirer, not the SPV, if applicable).

Sanctions: Up to the value of the transaction or up to 2 % of the sum of the total net worldwide turnover of the foreign investor (group level), whichever is higher. There are also different penalties for failure to provide the required cooperation.

Length of the proceedings: The Ministry of Economy must issue its decision within 130 days for critical investments and 45 days for non-critical investments. The Ministry may request additional information, which suspends the review period.

slovenia

your contact person: Matej Črnilec

Legal basis

Investment Promotion Act (Official Gazette of the Republic of Slovenia, Nos. 13/18, 204/21, 29/22 and 65/23).

Filing requirement

A notification obligation is triggered if the transaction:

- is one of the notifiable types of transactions;

- is conducted by a foreign investor; and

- is in one of the relevant sectors (see below).

Notifiable types of transactions are: (a) direct or indirect acquisitions of at least 10 % of the share capital or voting rights in a corporate entity registered in Slovenia; or (b) an investment in tangible or intangible assets for the establishment of a new corporate entity in Slovenia, where the foreign investor directly or indirectly acquires at least 10 % of the share capital or voting rights in a newly established legal entity in Slovenia (greenfield investments). A notification is also triggered by any subsequent acquisition of at least 10 % participation or voting rights.

A foreign investor is defined as a citizen of a third country (i.e. a country outside the EU) or a legal entity established in a third country that (a) intends to make a direct foreign investment in Slovenia or has already made such an investment, or (b) directly or indirectly holds at least 10 % of the share capital or voting rights in a legal entity established in an EU Member State and that intends to make a direct foreign investment in Slovenia or has already made such an investment. A foreign direct investment is defined as an investment by a foreign investor aiming to establish or maintain lasting and direct or indirect links between the foreign investor and a corporate entity established in Slovenia, by means of the first and any subsequent direct or indirect acquisition of at least 10 % of the share capital or voting rights in the corporate entity.

Relevant sectors

Relevant sectors include:

- critical infrastructure, whether physical or virtual (including energy, transport, water, health, communications, media, data

- processing or storage, aerospace, defence, electoral or financial infrastructure, and

sensitive facilities, as well as land and real estate crucial for the use of such infrastructure); - critical technologies and dual-use items, including artificial intelligence, robotics, semiconductors, cybersecurity, aerospace, defence, energy storage, quantum and nuclear technologies, nanotechnologies and biotechnologies;

- supply of critical inputs, including energy or raw materials and food security;

- access to sensitive information, including personal data, or the ability to control such information;

- the freedom and pluralism of the media; and/or

- projects or programmes of EU interest as listed in Annex 1 of Regulation (EU) 2019/452.

Process and timetable

Competent authority: Ministry of Economy, Tourism and Sport

Mandatory filing requirement: Yes

Filing deadline: 15 days from:

- the conclusion of the agreement under which a foreign investor directly or indirectly acquires at least 10 % of the share capital or voting rights in a corporate entity registered in Slovenia;

- publication of the takeover bid; or

- registration of establishment of a new legal entity in Slovenia.

The FDI Commission also confirmed in its decisions that it is possible to file the notification early and obtain clearance upfront, prior to the occurrence of any filing triggers (e.g. in case of stock exchange acquisitions).

Responsibility for filing: The foreign investor, target company or acquired company (merger or acquisition of an undertaking) or the newly established entity. Standstill requirement: No

Sanctions: A fine of up to EUR 500,000 may be imposed on corporate entities that were obliged to notify but failed to do so within the mandatory deadline. In addition, the representatives of the corporate entities may be fined up to EUR 10,000. Sanctions may also be imposed for non-compliance with the notification procedure.

Length of the proceedings:

Two months (instructive/non-binding deadline) from filing of the complete notification with the Ministry (a special FDI Commission will decide whether an in-depth screening is to be carried out once the notification is filed with the Ministry). In cases where in-depth screening proceedings (Phase II) are initiated, the FDI Expert Group (a specialised body within the Ministry) must deliver an opinion within two years from the date of the transaction or the entry of the newly established legal entity in the court register. Based on the opinion of the FDI Expert Group, the Ministry will decide within additional two months.

our experts

authors & contact people

- austria: Volker Weiss, Evelin Hlina

- bulgaria: Ilko Stoyanov, Ema Stoyanova

- serbia, bosnia & and herzegovina, north macedonia, montenegro: Danijel Stevanović

- croatia: Ana Mihaljević

- czech republic: Jan Kupčík

- hungary: Kinga Hetényi, Adrian Menczelesz

- moldova: Vladimir Iurkovski

- poland: Paweł Kułak, Krzysztof Pawlak

- romania: Georgiana Bădescu, Cristiana Manea

- slovakia: Michal Lučivjanský

- slovenia: Matej Črnilec